Why A Credit Card Comparison Worksheet Is So Important?

Contents

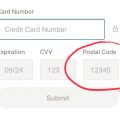

Owning a credit card these days is serious business. You do not want to own a credit card on a whim. So you need to exercise due diligence before applying for one. The credit card comparison worksheet is one way of knowing which credit card to subscribe to and you can learn more about it in this post.

What is a credit card comparison worksheet?

There are so many credit card options out there. And each credit card has its benefits and drawbacks. In order to compare and contrast credit cards to know which would be ideally suited to your needs, you can use a credit card comparison worksheet. All you do is write or type out the credit card and then compare each one on the basis of certain important parameters. These parameters may include; the credit card moratorium (grace period), APR, Required credit score, interest rates, fees and also rewards.

Сredit card comparison worksheet a useful tool

A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees. Others may have low-interest rates and fees but offer very little by way of perks. With a comparison worksheet, you will be able to categorize the credit cards and decide for yourself which is ideal for you.

Use a credit card comparison worksheet in choosing which credit card to apply for

As a general rule, avoid owning several credit cards. Having a lot of credit cards even if your credit is good, can be a big temptation. It could lead you down the road of huge debts. Be picky with credit cards and use a credit card comparison worksheet to help you decide.