What Is A Recurring Credit Card Authorization Form?

Contents

Credit cardholders may wish to enjoy certain goods and services on a regular basis. Instead of swiping their credit card any time they want to secure that commodity, they can make use of a recurring credit card authorization form. This article explains what this form is, how it is set up and also how it can be canceled.

If you wish to make use of your credit card in securing a commodity on a fairly regular basis, such as paying utility bills. You can enter into an arrangement where you authorize the deduction of the fixed amount used in paying for the commodity from your credit card account. This arrangement involves an express agreement that is signed, sealed and delivered by way of a recurring credit card authorization form. The payment authorization recurring period maybe weekly, monthly, quarterly, semi-annually or annually. It all depends on the agreement between you as the credit card holder, the company providing the commodity and credit card issuing firm or bank.

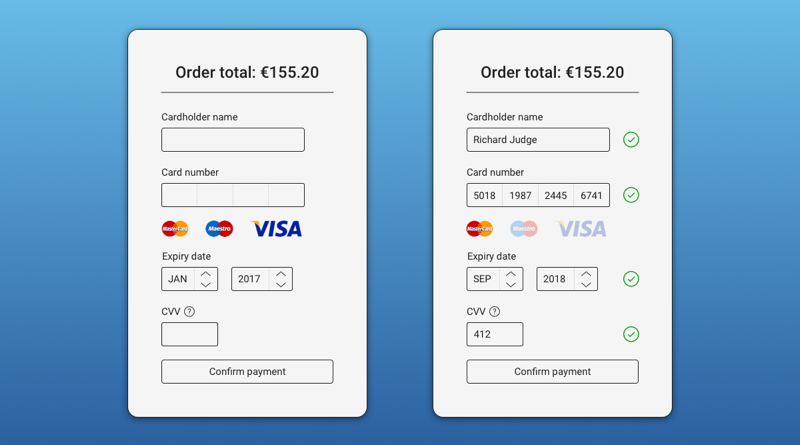

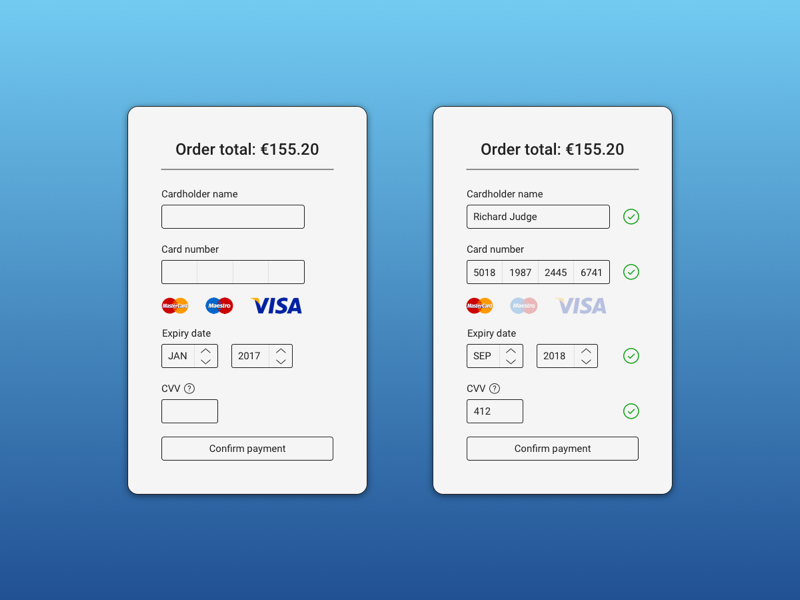

A recurring credit card authorization form may be set up either in person or online. With the former, the credit card holder has to be present in the flesh. A typical use of this type of authorization form is at a gym or yoga class. In terms of the latter, you authorize a recurring payment for an online transaction. The online type of authorization requires less paperwork and is significantly less cumbersome. Once you have read the “Service Terms” of the online business and you have accepted their terms, the authorization becomes active.

Canceling a recurring CC payment

To cancel a recurring CC payment, you can either go to the place of business in person or you may go online. You could also call the business to indicate your intention to cancel a recurring credit card payment if you prefer.